There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Complete Practical Guide to Payroll by Industry-leading Payroll Consultant | 11+ Hours

| star star star star star | 5.0 (52 ratings) |

Instructor: Rishabh Jain ( Labour Law Advisor )

Language: Hindi

Validity Period: 365 days

India has emerged as the fastest-growing economy in the world and as new investments are made and new businesses flourish, there's an ever-increasing demand of payroll professionals in the country. This demand continues to increase even in times of crisis.

Payroll is one of the most important aspects of the business. It affects employee morale and reflects a business's financial stability and reputation. So, in order to save time, money and compliance headache businesses prefer to outsource their payroll function to professional service providers. They streamline the process right from the day to day maintenance of prescribed records, calculating & disbursing salaries to calculating liabilities of the company and filing various statutory compliances such as PF, ESI, Professional Tax, TDS, Gratuity etc.

Why this course?

Payroll Processing is a very high-grade profession in which you have to onboard a client just once and he will be giving you recurring earnings with every payroll as people usually never shift from their professional consultants.

The course is designed for those who wish to learn about payroll processing in a practical, organised and effortless way. It provides in-depth knowledge on all the areas of payroll - Calculations, Forms, Formats & Due dates etc.

There are no prerequisites to enrol in this course. It does not matter if you are from a non-HR background, whether you are a student, professional or a businessman; as this course is tailored to expand your professional knowledge and value.

After completing this course, you will be able to confidently file compliances on your own and will be in a position to -

Who should take this course?

This online labour law course will be extremely beneficial for founders and entrepreneurs of new startups and companies. It will also benefit Consultants, HR managers, Chartered Accountants, Accountants of established companies. Additionally, HR students can supplement their course with these materials. One does not need to have any educational degrees in HR, accounting or law to partake in this online course.

What is the course structure?

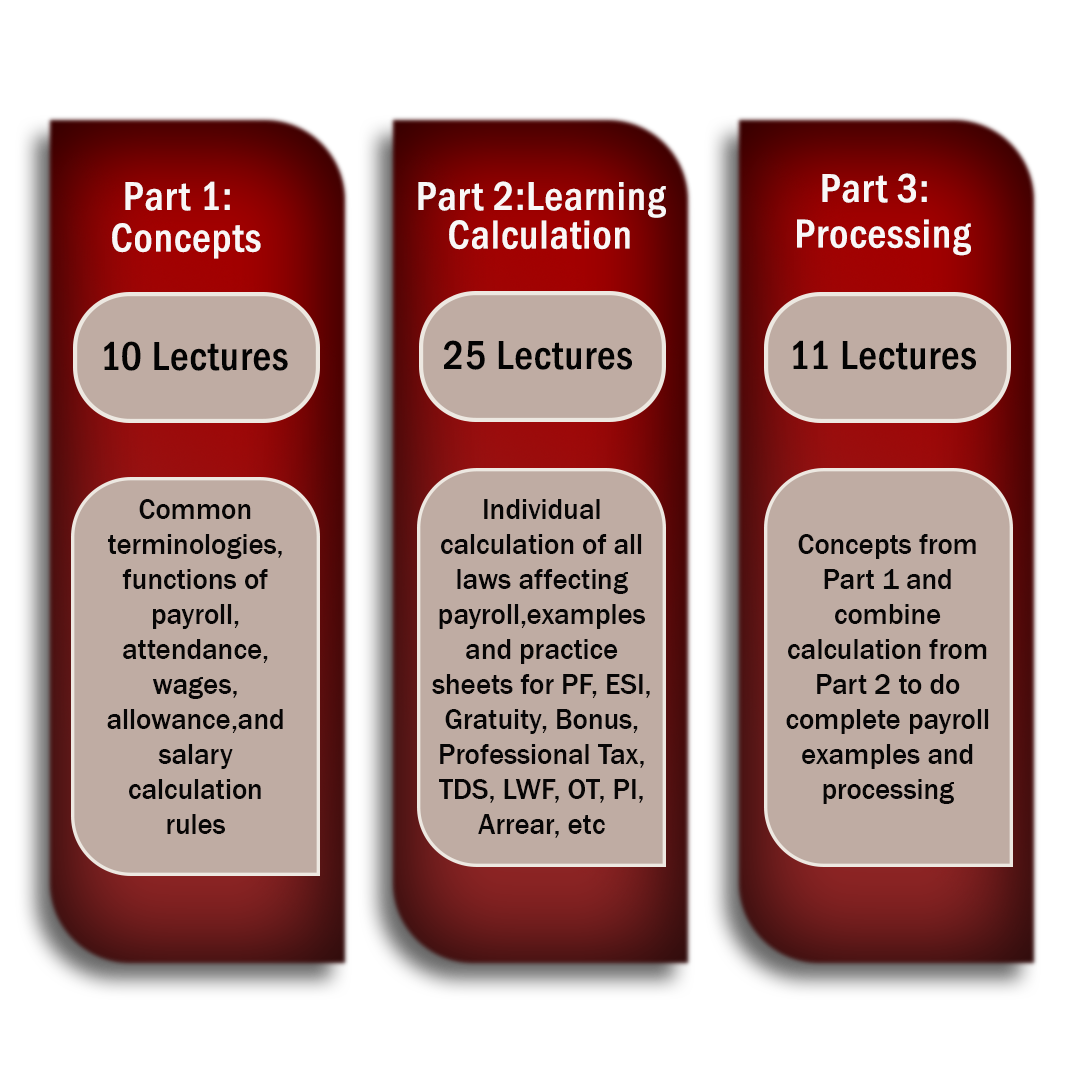

This course is divided into 3 sections which cover all practical aspects of payroll calculation. It includes all statutory and non-statutory components, forms and templates, downloadable calculators and case studies.

The following topics will be covered in the course:

1. Concepts Section

10 Modules - In this section, we will familiarize ourselves with common terminologies, rules and functions of payroll. We will cover Definitions, Allowances, Calculation methods & formulas, Leaves, Attendance etc

2. Calculation Section

10 Modules - Here we learn the individual calculation of all laws affecting payroll. Such as PF, ESI. Income Tax, PTax, LWF, Bonus, Gratuity etc. We will do individual examples assuming that there are no other components.

3. Processing Section

10 Modules - Here we combine learning from the first 2 sections to process actual payrolls. Also, we will discuss various reports in brief.

Who will be your trainer?

Mr. Rishabh Jain

How my doubts will be solved?

Along with the course, you also get access to the course discussion forum. You can ask any questions and I will answer them personally within 24 hours.

What is the course timing?

This is a pre-recorded course, hence you can watch at any time, anywhere. You can watch as many times as you want.

Technical Details

Watch Demo Videos:

Chapter 1: About the Course

Chapter 2: Course Structure

To join this course click on add to cart button.